INTRODUCTION

This training course will empower you in obtaining an in-depth and comprehensive knowledge of theoretical as well as practical aspects of Public Financial Management. The course is designed to strengthen participants’ abilities to assess why Public Financial Management (PFM) is important; and how it supports macroeconomic stability, economic growth, and the achievement of the Sustainable Development Goals. Over five parts, the course modules cover all stages of the budget cycle, and discuss key concepts from budget preparation to government accountability in budget execution, and reform implementation.

Why you should attend the Masterclass in Public Financial Management and Administration? The nature and size of expenditure in governments are changing rapidly. As a professional working in the public sector, you must be aware of the principles of Public Financial Management because your role serves as a cornerstone in Public Financial Management.

DURATION

5 days.

COURSE OBJECTIVES

By the end of this training you will be able to:

- Evaluate the policies implemented and take corrective actions

- Understand the risks involved in Budget Execution

- Understand the Budget Preparation Strategy

- Implement the Internal Control Policies in Budget Execution

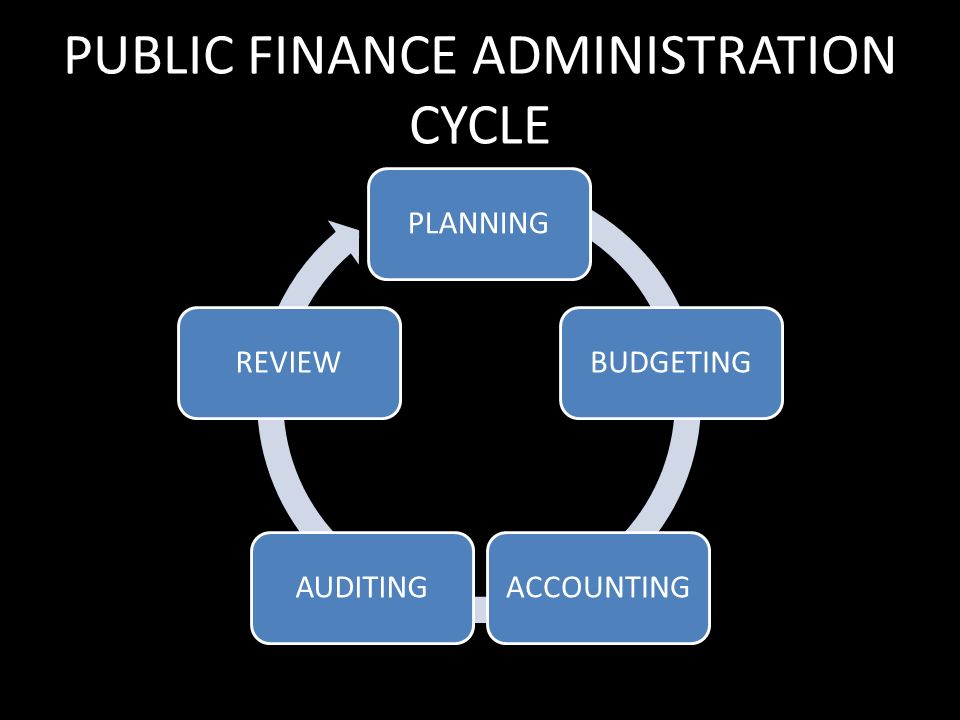

- Understand the Public Financial Management cycle

Who should attend?

Accountants working in the Government and Other Public Sector Entities, Auditors working in Supreme Audit Institutions, Diplomats, Envois, Ambassadors, Policy Makers in the Public Sector

COURSE OUTLINE

Module 1: Introduction to Public Financial Management

- Public Financial Management Framework

- Objectives of Public Financial Management

- Fiscal Policy

- Budget Cycle

Module 2: Budget Strategy

- Budgeting and budgeting techniques

- Revenue management

- Project management

Module 3: Budget Formulation

- Annual Budget

- Medium-Term Budget

Module 4: Budget Approval

- Legislative Approval

- PFM Act

- Legal Aspects of Budget Approval

Module 5: Budget Execution

- Budget execution strategy

- Budget execution cycle

- Cash planning

- Debt management

- Procurement

Module 6: Accounting and Internal Control

- Financial Management Information Systems

- Accounting aspects – Accrual and Cash basis IPSAS

- Internal Control Policies

- Internal Audit

Module 7: External Audit

- Supreme Audit Institutions

- International Auditing Standards

- Fiscal Councils

- Legislature Oversight

- Public Participation

Module 8: Budget Evaluation

- Budget Feedback

- Comparing Actuals vs Budgets

- Fiscal Transparency

- Updating the Budget Strategy

Training Approach

This course will be delivered by our skilled trainers who have vast knowledge and experience as expert professionals in the fields. The course is taught in English and through a mix of theory, practical activities, group discussion, and case studies. Course manuals and additional training materials will be provided to the participants upon completion of the training.

Tailor-Made Course

This course can also be tailor-made to meet organization requirements. For further inquiries, please contact us on Email: training@upskilldevelopment.com Tel: +254 721 331 808

Certification

Participants will be issued with Upskill certificate upon completion of this course.

Airport Pickup and Accommodation

Airport pickup and accommodation is arranged upon request. For booking contact our Training Coordinator through Email: training@upskilldevelopment.com, +254 721 331 808

Terms of Payment: Unless otherwise agreed between the two parties payment of the course fee should be done at least 3 working days before commencement of the training so as to enable us to prepare better